Donate your tax credit

Have you considered donating your tax credit to Variety – the Children’s Charity?

For every donation you make over $5.00 you can claim 33.33% back as a tax credit from IRD at the end of the tax year.

If you receive a tax credit, Variety – the Children’s Charity would be thrilled to receive it. Every little bit helps to support Kiwi kids living in poverty in New Zealand. See how you can help below...

Did you know that you can claim 33.33% back in tax credit for every $5 donation you make?

How to claim or regift your tax credit

For every donation you make over $5.00, you are able to claim 33.33% back in tax credit, and you can claim up to 4 years previous if you haven’t already done so. Below are instructions on how you can claim back or gift your tax credit through IRD.

You will need an IRD login.

Below is a step-by-step guide on how to claim or gift your tax credit:

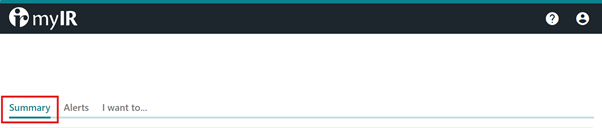

- Register, or log into your myIR account. If you don’t have one, you will need your IRD number. When signing up please select that you want to be able to receive donation tax credits.

- Once you have signed in and are on the ‘Summary’ page, select ‘I want to..’ and scroll down to ‘Registration, application and enrolment’ and select ‘Register for donation tax credit’

- You will need to answer several questions assessing your eligibility, then select ‘next’ at the bottom right of the screen

- Go back to the ‘Summary’ screen

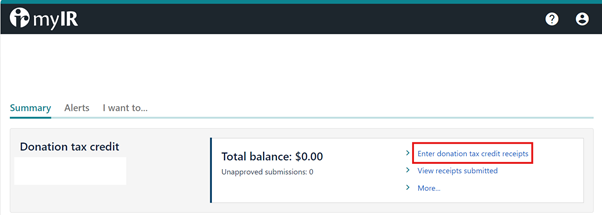

- You will now see ‘Donation tax credit’ Select ‘Enter donation tax credit receipts’

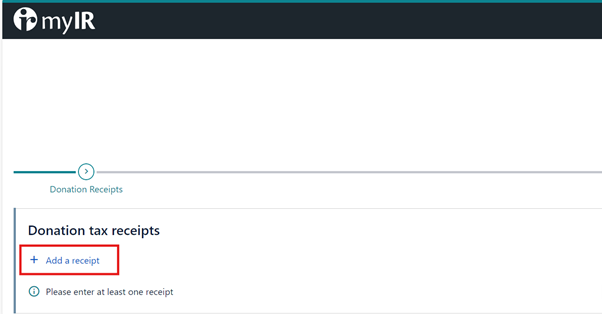

- Under ‘Donation tax receipts’ click on Add a receipt

- Enter in the details requested, all of which can be found in your donation receipt. You will need to enter in the details of the donee/organisation.

This is Variety – the Children’s Charity - Our charity registration number is CC24039

- You will need to enter our IRD number which is 052-122-309 and the amount you have donated. You can find this on your donation receipt.

- Donation type is: ‘Other donee organisation’

Select whether or not the receipt is shared with a spouse or partner and include your receipt date and receipt amount. - Attach your receipts to support your claim

- Click ‘Next’

- Confirm and submit donation receipts

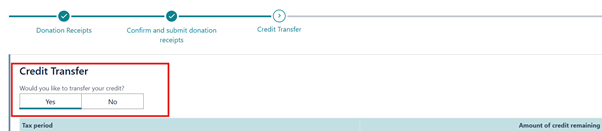

- On the final page you will be asked if you would like to transfer your tax credit. You can press ‘yes’ if you wish to do so and ‘no’ if you would like the credit to come back to you.

If you would like to transfer your credit back to Variety, thank you so much!

You are able to do this at the end of the process by clicking ‘Yes’ to credit transfer.

Thank you so much for your ongoing support, you are helping to transform young Kiwi lives

Fundraise for Variety and Kiwi kids

Variety's team can answer any questions you may have about how to get started, please contact:

Variety is a registered charitable organization under the Charities Act 2005.

Our Charities Commission registration number is CC24039.